Case Study

Social Listening Delivers New Market Intelligence for Global Biopharma Brand

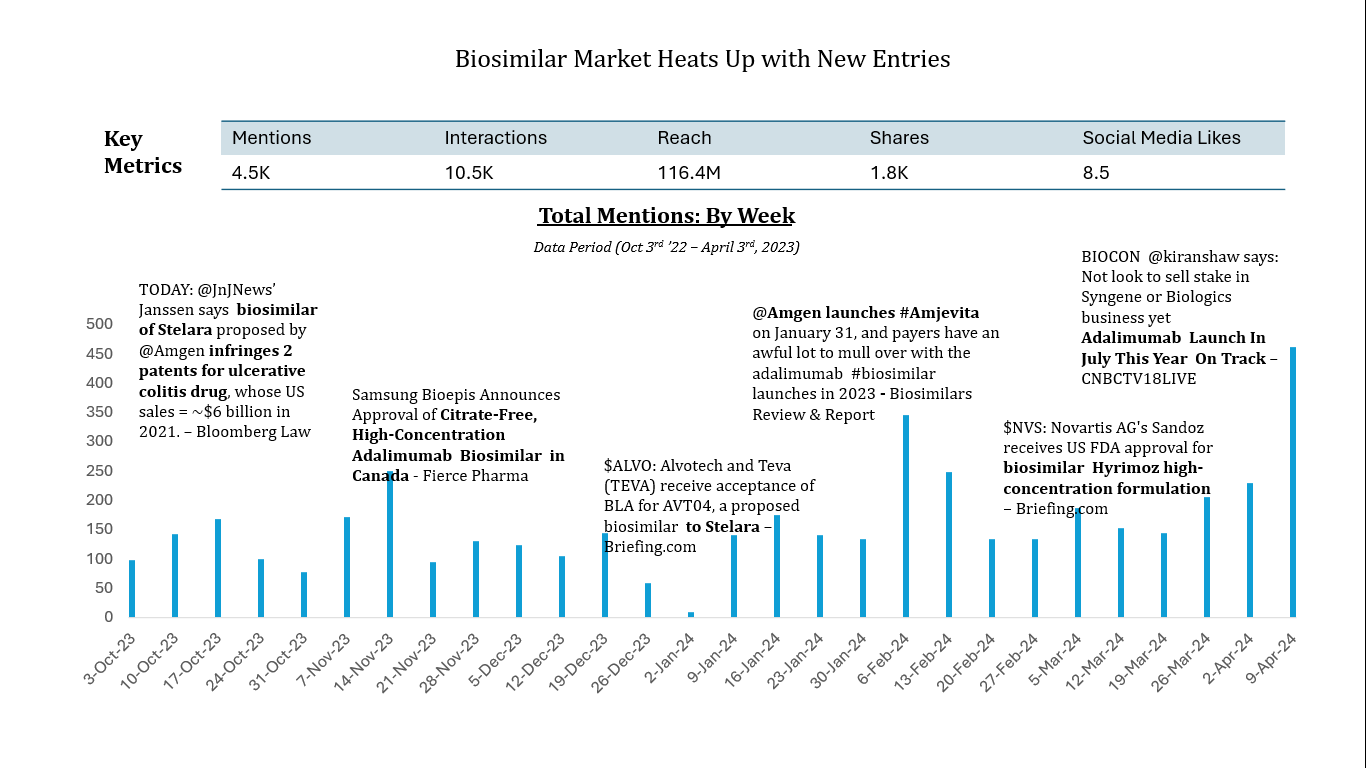

In early 2023, our client, a global pharmaceutical company, embarked on a comprehensive social listening study to explore the online landscape of biosimilars, with a particular focus on the highly competitive market for Humira® biosimilars.

The biosimilar sector is complicated, marked by regulatory challenges, competitive forces, and diverse perspectives. Our client saw the importance of engaging with a broad group of stakeholders, including HCPs, patients, advocacy groups, government agencies, specialty pharmacies, payor groups, and regulatory bodies. The urgent need to keep up with fast-changing discussions and identify key influencers to shape these conversations added to the challenge.

Our study encompassed online data published or shared between Q4 2022 to Q1 2023. To arrive at a deeper analysis of the content, we manually read and tagged approximately 500 content assets shared online. Our analysis also focused on commercial stakeholders involved in the launch of biosimilars in the US market.

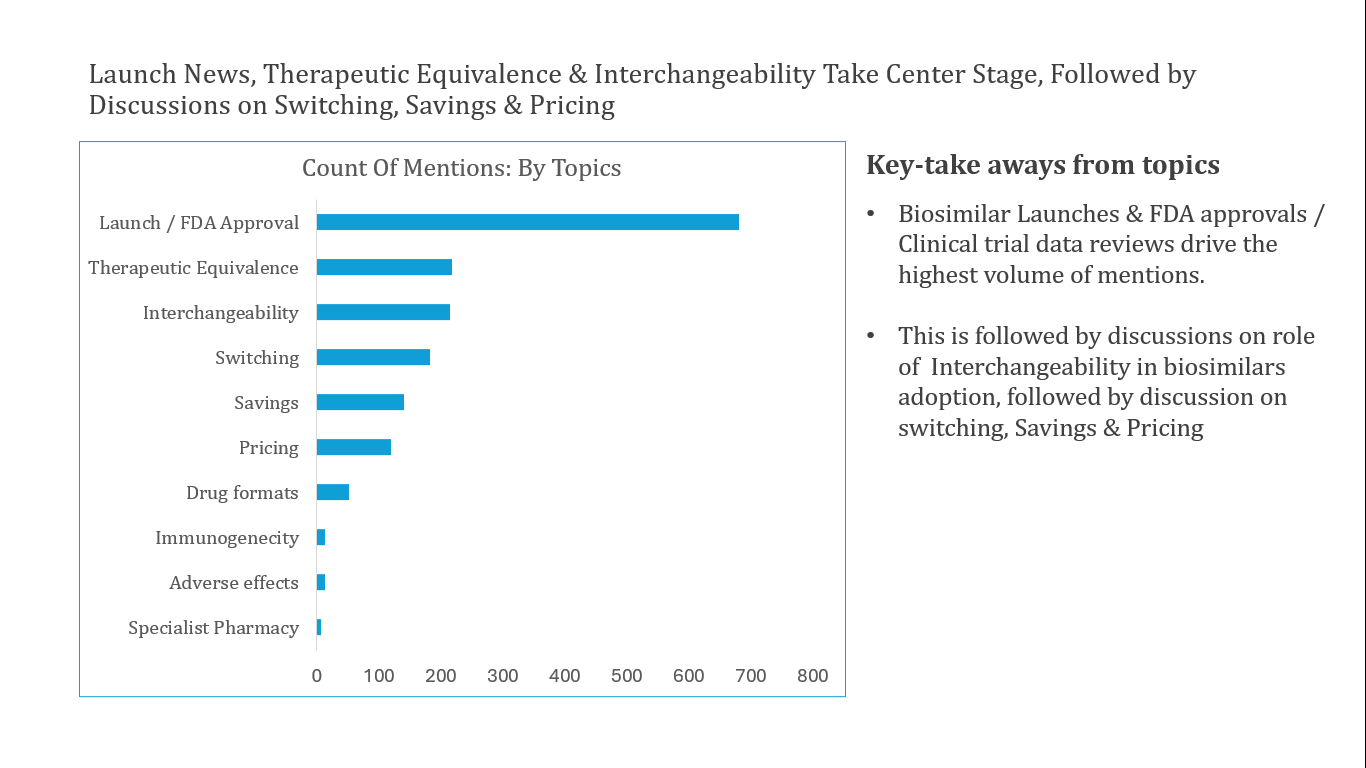

Through our content analysis, we identified the following major themes:

- Launch News and Biosimilar Approvals: Our analysis of news and media sources revealed a significant surge in biosimilars, particularly for medications like Humira and Stelara®. These approvals were mainly for treatments classified as pharmacy benefits, not medical benefits. The launch of biosimilars of these blockbuster drugs has led many industry leaders to predict higher competition between vertically integrated IDNs and PBMs, particularly in the management of specialty pharmacy operations for these medications.

- Therapeutic Equivalence and Switching: Stakeholders, including HCPs and patients, recognized that biosimilars are as effective as their original biologic counterparts. However, they had concerns about mandatory switching. Research on pharmacist stakeholders revealed the important role they can play in encouraging the use of biosimilars.

- Biosimilar Interchangeability: PBMs saw interchangeability as a key differentiation factor but underlined the importance of rebates and consistent supply. Doctors, meanwhile, had mixed feelings. Some pharmaceutical companies contested the designation of interchangeability. Government and FDA efforts focused on harmonizing regulations with entities like the European Medical Administration to standardize practices globally.

- Pricing and Formulary Coverage: Amgen’s dual pricing strategy for its Humira biosimilar, Amgevita®, attracted considerable attention. Critics questioned the incentives favoring PBMs and highlighted broader systemic issues in healthcare. Advocacy groups favored standardized plan options, pushing for separate tiers for generics and biosimilars to enhance patient access and cost savings. Meanwhile, payers' decisions on formulary inclusion for biosimilars varied, with ongoing discussions about ways to encourage HCPs and patients to embrace biosimilars.

- Biosimilar Cost Savings: Some experts argue that the true savings of biosimilars are often obscured, as many biosimilar manufacturers launch with high wholesale acquisition costs to align with the PBM model. However, others cite evidence of significant savings across the entire category following the launch of biosimilars.

Our research provided a detailed overview of the biosimilar landscape, revealing both opportunities and challenges sparked by an increase in product offerings, changing pricing strategies, regulatory shifts, and complicated formulary decisions. Here’s the value the study delivered:

- Informed Decision-Making: The insights allowed our client to make well-informed decisions quickly, adapt to market changes, and navigate a complex array of stakeholders.

- Content Roadmap: We developed a detailed content roadmap to engage with diverse stakeholders, ensuring our client could communicate strategically across various channels.

- Competitive Advantage: The study provided our client with a deep understanding of stakeholder perspectives and industry conversations. This knowledge empowered their teams to develop new, robust strategies, prepare for key discussions, and make informed market entry and investment decisions.

Overall, our client gained a significant edge in the competitive biosimilar market by helping them anticipate market needs and tailor their approach to meet them. Our client's teams were able to form their own strategies, compile necessary support documents, and prepare for important discussions. This deep market insight can now serve as a rationale for decisions regarding market entry, investments, and future product launches.

Ready to elevate your brand with a cutting-edge omnichannel strategy?Connect with Asentech today, and discover how we can guide you toward omnichannel excellence for a successful launch.